Deciphering BIIB Stock Price: To Buy or To Fold

Updated Oct 22, 2023

Biogen’s Innovative Model: Driving Growth with Promising Therapies

Massachusetts-based Biogen is a global biotechnology leader, researching and developing therapies for debilitating diseases impacting the central nervous system. Founded in 1978, Biogen has pioneered numerous breakthrough treatments through dedicated research into neuroscience. Currently, one of Biogen’s most active therapeutic areas involves multiple sclerosis (MS), with the company developing some of the earliest approved MS drugs. Beyond MS, Biogen also investigates therapies targeting Alzheimer’s disease, Parkinson’s disease, spinal muscular atrophy, and stroke.

Through a vertically integrated approach combining internal R&D with strategic licensing deals, Biogen remains at the cutting edge of neuroscience. This innovative business model empowered the company to establish industry-leading MS and biosimilar drug franchises. However, as key drug patents expire, maintaining growth depends on success in replacing lost revenue. Investors closely monitor BIIB stock price performance relative to pipeline progress, raising questions – does Biogen’s promising research justify its current valuation?

Top Products Driving Revenue: BIIB’s Foundation for Future Growth?

Currently, Biogen derives significant revenue from blockbuster MS and haemophilia treatments. Multiple flagship products, including TECFIDERA, AVONEX, and TYSABRI represent the company’s foundation. These drugs collectively generated over $9 billion in 2020 sales.

Within MS, TECFIDERA offers an important oral alternative to injectable therapies. Notable for its favourable efficacy and safety profile, TECFIDERA captured the largest market share of all MS drugs by 2017. However, concerns linger regarding pending patent expirations. What impact might cheaper generics have on BIIB stock price if TECFIDERA loses exclusivity in 2028 without a novel blockbuster in place?

Meanwhile, Biogen intends to leverage its haemophilia expertise. With ELOCTATE and ALPROLIX, the company commands over 30% of the haemophilia A market. However, revenues rely on just two products. How might BIIB’s stock price react if either faces biosimilar competition? Their future clearly depends on continued clinical research progress.

Breakthroughs on the Horizon: Is Biogen’s Pipeline Promising Enough?

Biogen faces looming franchise declines if it does not successfully replace lost sales with novel therapies. Fortunately, the company’s pipeline addresses high-value indications like Alzheimer’s disease, which could stimulate BIIB stock price if positive results are demonstrated.

Most notably, aducanumab represented Biogen’s first Alzheimer’s drug, potentially modifying disease progression rather than just managing symptoms. After early termination, the controversial therapy was reinstated based on delayed data analysis suggesting efficacy in slowing cognitive decline. However, adoption hurdles remain. How will the FDA’s final decision and demand for this first-in-class treatment impact the stock in the long term?

Equally controversial, the anti-amyloid drug lecanemab recently showed promising Phase 3 results, reducing clinical decline by around 27% vs placebo at 18 months. But questions persist regarding durability and the overall benefit of these mechanisms. Investors eagerly anticipate upcoming presentations – could lecanemab be the breakthrough needed to justify BIIB’s current high valuation?

Amyloid remains a high-risk strategy with limited efficacy to date. Biogen faces questions if failing to establish these mechanisms or prove their significance quickly enough. The aging population demands therapies stabilizing or reversing cognitive loss, shifting the goal posts for what constitutes a success in Alzheimer’s. How might this influence future trials and innovation at Biogen?

Looking to Leverage Strengths: Strategic Partnerships Fueling Growth

Biogen consistently supplements internal innovation through targeted business development deals. Notable past agreements include acquiring rights to develop ocrelizumab (OCREVUS) for MS, which became the company’s best-selling drug. Similarly, a recent $1.5 billion collaboration with Denali Therapeutics focuses on developing treatments for Parkinson’s and other neurodegenerative disorders.

Partnerships represent an attractive option for boosting Biogen’s pipeline since large pharma increasingly seek to license or acquire external assets. Could Biogen strategically leverage its extensive neurological expertise through future licensing agreements for experimental compounds? This represents an important area for investors monitoring BIIB stock price and the company’s longer-term success in replacing lost revenues. However, investors question if Biogen may spread itself too thin.

Overall, Biogen faces significant challenges retaining leadership as drugs lose exclusivity, increasing pressure to deliver successes consistently. While the pipeline addresses high-value indications, uncertainty clouds many of these programs. Moving forward, does Biogen possess the right strategy and execution to justify Wall Street’s optimism reflected in its current stock valuation?

Technical Look: Is BIIB Stock Poised for More Gains?

Stepping away from fundamentals, let’s analyze BIIB’s technical performance, which provides contrarian perspectives on mass sentiment. After bouncing from pandemic lows, the stock broke multi-year resistance in 2021, signalling renewed buying pressure. This upthrust coincided with aducanumab’s approval, underscoring biotech’s sensitivity to catalysts.

However, since peaking above $400, bears questioned if elevated valuations factored realistic expectations.

You might expect a stock that plummeted from 468 in 2021 to dip below 190, trading in the ‘extremely oversold’ category on long-term charts. But here’s the twist – it’s almost hitting ‘extremely overbought’ levels on the charts!

If you’re eyeing this stock for a long-term investment with a horizon beyond 36 months, you might want to hold off. However, if you’re a momentum trader, now could be the perfect time to dive in. This stock is currently in the ‘extremely oversold’ range on weekly charts and is poised for a rally, likely reaching the 306 to 318 range before encountering substantial resistance.

But for a safer and more reliable investment in the biotech sector, consider the NBI. It’s trading in the ‘extremely oversold’ zone on monthly charts and provides access to a diverse range of biotech companies, reducing the risk of unforeseen hiccups.

While you can’t invest directly in the NBI, fear not! We’ll show you some indirect routes to tap into this index’s potential.”

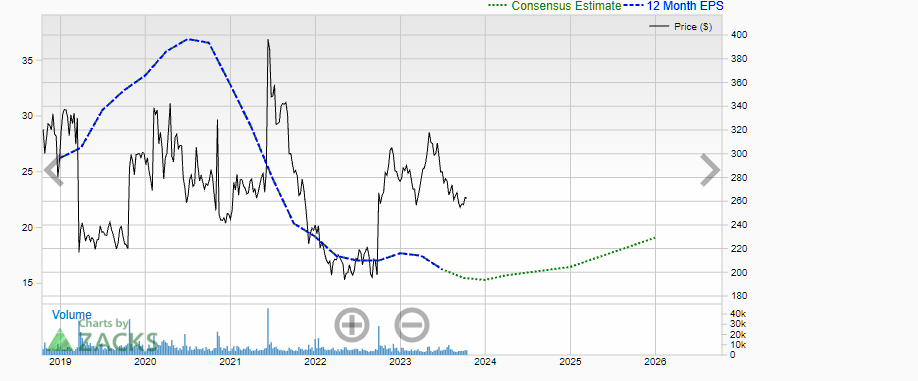

Unveiling the BIIB Stock Price: Rising Above EPS Challenges

The BIIB stock journey has been a rollercoaster ride, and its EPS performance has been a defining factor. While the recent upward movement is promising, it’s crucial to acknowledge that the road to recovery might still be long. Crossing the 320 threshold will be a significant milestone to affirm a fresh trend.

For those with a keen eye on long-term investments, the pattern of higher EPS lows is a hopeful sign that the stock is on the path to a brighter future. Nonetheless, it’s essential to reiterate that this journey might require a longer-term commitment.

If you’re not ready for that kind of commitment, don’t fret. The Biotech sector, brimming with opportunities and potential, is just a step away from the convenience of an ETF. We’ll help you explore the promising avenues within the sector, making your investment journey exciting and informed.

Biotech Sector’s Weighted Average Signals Contrarian Buy

source: https://www.barchart.com/

While the outlook for BIIB remains somewhat unclear, the chart above suggests that now might be a favourable time to establish a position in the sector through an ETF such as XBI or some of the options mentioned below. From a contrarian perspective, it’s advisable to enter an industry when it is trading in oversold ranges on the monthly charts, which seems to be the case for the biotech sector. Additionally, it’s prudent to enter when the average weighted alpha is trending toward the lower end of the 12-month average. This trend indicates that the general public has not yet embraced the sector.

Following principles of mass psychology, the optimal time to enter a sector is when the crowd has not yet hopped on the bandwagon. Once they catch on to a trend, it’s often too late, and the Fear of Missing Out (FOMO) stage follows, leading to unfavourable outcomes.

Unlocking Biotech Investments: Navigating the NASDAQ Biotechnology Index

The NASDAQ Biotechnology Index (NBI) is an index, not a direct investment. It tracks the performance of a group of biotechnology stocks listed on the NASDAQ stock exchange. As an index, it cannot be purchased directly.

However, there are a couple of ways individual investors can gain exposure to the biotechnology sector and companies that comprise the NBI index:

1. Biotechnology ETFs: Several ETFs track and aim to replicate the NBI index. Some examples include the First Trust NASDAQ Biotechnology ETF (FBIO) and the SPDR NASDAQ Biotechnology ETF (IBB). These ETFs hold positions in the index components and allow buying a single security to gain index exposure.

2. Buy constituent stocks: The NBI index consists of dozens of biotech company stocks listed on NASDAQ. An investor could research the current holdings and purchase shares of individual index constituent stocks to build their portfolio, replicating the index performance. This requires more active management versus a passive ETF.

3. Biotech mutual funds: Some biotech sector mutual funds also construct their portfolio based on the NBI index holdings. Investing in these funds offers index-tied exposure through regular mutual fund shares.

So, in summary – the NBI itself cannot be directly purchased. Still, ETFs, individual stocks, or mutual funds allow individuals to gain investment exposure by tracking this benchmark index of NASDAQ-listed biotechnology companies. An ETF is likely the most straightforward option for most passive retail investors.

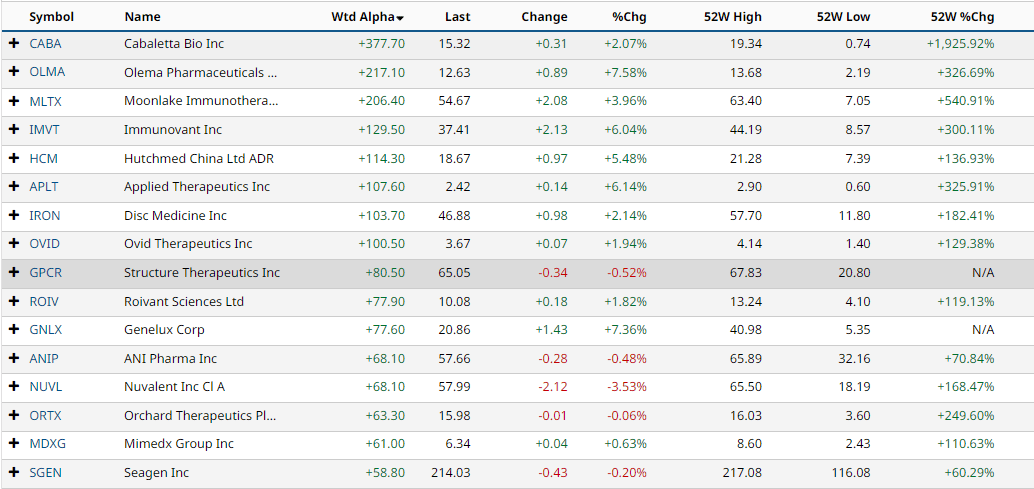

Elite: Top 16 Biotech Stocks for Success

source: https://www.barchart.com/

For bold investors seeking potential rewards and willing to put in the effort, the following list unveils the top 16 stocks in this sector. But, remember, don’t leap without looking – roll up your sleeves. Seek out stocks trading in monthly oversold ranges, with robust EPS growth, a solid Price-to-Sales ratio, and other key factors for success.

Additionally, the Nasdaq Biotech Index offers potentially outsized returns compared to a passive ETF. Some of the biggest winners of the last decade were NBI constituents, where savvy stock pickers identified compelling buying opportunities.

A few stocks frequently appearing among the largest NBI holdings include Amgen, Gilead Sciences, Biogen and AbbVie. Investors may spot underappreciated opportunities by filtering these newsworthy names through a value investing lens. For example, manually scanning monthly/weekly charts could reveal periods where emotional selling drags prices to enticing oversold levels.

Fundamental analysis also differentiates stock pickers – searching for firms with strong balance sheets, growing earnings, reasonable valuations, and promising pipelines may uncover hidden gems. During inevitable biotech industry downturns, leaders with durable competitive advantages sometimes see temporarily discounted share prices.

While increased risk accompanies individual stock picking, the biotech sector’s volatility cuts both ways. Bold investors who are comfortable doing their homework could beneficially leverage short-term price dislocations within bellwether names. History shows biotech fortunes can change swiftly – remembering that may inspire confidence facing short-term uncertainty.

By thoughtfully focusing on just a few prime biotech candidates meeting specific criteria, investors gain more direct exposure to industry outperformance than general ETFs. With discipline and experience, separating winners from losers becomes more intuitive over time as well. For adventurous long-term investors, taking a stock-picking approach to the innovative Nasdaq Biotech Index offers compelling upside potential.

Looking Ahead: Will Biogen Continue Leading Innovation?

Ultimately, Biogen’s future depends on consistently developing crucial next-generation therapies. While the company built industry-leading franchises, success now hinges on effectively implementing the right strategies. Biogen’s current valuation appears to discount pipeline potential, but questions remain if programs can validate bullish assumptions. For long-term investors, will Biogen overcome its limitations through internal expertise leveraged with strategic partnerships?

Considering Biogen’s existing market position, substantial financial resources, and decades of neurological expertise, the company retains advantages in pursuing high-impact indications. Staying at the forefront of driving medical innovation through creative R&D represents their clearest path to sustaining leadership. However, significant challenges lie ahead demonstrating advantages over competing platforms. With several years remaining before lost revenues fully materialize, Biogen’s efforts now take center stage as the market weighs whether they merit Wall Street’s enduring optimism. Continued progress under interim leadership seems buoying confidence, positioning BIIB stock favorably if delivering future wins against formidable competition seeking to disrupt Biogen’s franchises. Overall, the company’s divergent efforts fighting neurodegeneration leave plenty still unfolding that investors must closely monitor in weighing BIIB’s long term potential.

Hence only use you don’t need for your daily expenses and money you can afford to keep locked up for up to three years.

Challenges Ahead for BIIB Stock Price and Team

Challenges of Alzheimer’s Innovation

treating Alzheimer’s poses immense challenges, given the complex aetiology of disease pathology and decades of prior failed clinical trials. While amyloid represents a logical target, its efficacy alone seems inadequate. Biogen now investigates next-generation anti-amyloid antibodies like lecanemab, but even demonstrating more robust effects won’t ensure regulatory approval or adoption as an initial monotherapy given limited durability.

Could multi-targeted approaches prove safer and more enduring? Pursuing alternative mechanisms beyond amyloid offers potential, though also uncertainty. Investors question if Biogen can establish effective solutions in time to validate Wall Street expectations. Succeeding demands not just scientific wins but also navigating political and reimbursement realities of bringing first-to-market Alzheimer’s treatments to patients.

Future Strategic Considerations

While partnerships bolster capabilities, investors ponder Biogen’s optimal path – should it prioritize high-risk bets like gene therapy over external licensing? Further assessing Biogen’s fundamental strengths and weaknesses seems merited. Advantages include proven development/regulatory expertise, yet pursuing every modality risks resource overextension.

Leveraging strategic options astutely represents an alternative. For instance, out-licensing promising assets attracts non-dilutive funding while maintaining influence. Selling mature products like TECFIDERA could replenish capital for riskier exploratory work. Does Biogen’s leadership possess the vision of weighing science versus business priorities under limited timetables? Their ability to navigate an ever-complex therapeutic landscape remains top of mind for shareholders.

BIIB Stock Price: Opportunity or Speculation

From a contrarian viewpoint, Biogen offers speculative potential. Should lecanemab establish amyloid’s significance, the stock could surge on first-mover advantages. Even partial clinical benefits may attract Wall Street optimism if treatment options are expanded. However, the downside competing scenarios are no less plausible – incomplete efficacy fuelling disappointment or limited adoption quashing revenue forecasts.

For more risk-tolerant investors, BIIB remains an intriguing way of playing innovation at an attractive point, discounting pipeline hopes. But more conservative buyers might reasonably wait for further data validating effectiveness against Alzheimer’s before considering a position. Biogen’s long-term trajectory depends on resolving many still-open questions around addressing neurodegeneration.